Frequent Questions

What does it cost to renew my vehicle?

To renew your vehicle plate, you are required to pay a State registration renewal fee and personal property tax annually.

- Registration fees can cost between $39 and $49 per year.

- Property tax can be estimated by going to the state’s Property Tax Calculator and entering the owner’s last name initial, year, make and model of the vehicle.

- An additional fee of $5.00 will be applied to each vehicle being renewed in-person.

When should I receive a renewal notice?

The county mails courtesy renewal notices 30 days prior to your expiration date.

What if I don't receive a renewal notice?

The county generates courtesy notices 30 days before the vehicle’s expiration date, but it is still your responsibility to renew in a timely manner. Lost or missing reminders occur most often when you have recently moved and the reminder has been sent to a previous address.

If you intend to renew in person, the renewal notice is not necessary; however, you will need proof of insurance, any other applicable paperwork, and the license plate number.

What if my decal is lost in the mail?

If you do not receive your decal in the mail within 10 days from mailing in your payment, contact our office at 620-330-1150 to inquire if the decal may have been returned to our office. If the decal has been returned, give the customer service representative the correct mailing address and the decal will be either sent out again or held in the office if you want to pick it up in person.

If the decal has not been returned, a police report must be filed in the city in which you reside. After filing the police report, bring the report, license plate number of the vehicle, insurance information and $1.50 to either motor vehicle office to obtain a replacement decal. This must be done by the registered owner of the vehicle.

How much is the sales tax on my vehicle?

You may pay a sales tax the first time you register a new or used vehicle if purchased from an individual or an out of state dealer.

To calculate sales tax, visit Kansas Department of Revenue Sales Tax Calculator.

How much is personal property tax on a vehicle?

Vehicle property tax is due annually. You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration.

Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by make/model/year, VIN or RV weight/year, for a partial or full registration year.

Who do I call if I have more questions?

The Montgomery County Tag office phone number is 620-330-1100.

We have a great staff ready to help you.

Auto Tag

The Auto Tag office provides a comprehensive range of vehicle services to ensure that your needs are met when it comes to owning a vehicle. If you need to register your vehicle, look no further than our helpful team who can guide you through the process and answer any questions you may have. Need to obtain or replace license plates and decals? Not a problem, we have you covered. We also assist in renewing vehicle registrations, changing or replacing a title, updating addresses, and so much more. Our mission is to deliver a hassle-free and comfortable experience to all our customers, and we are always happy to assist you.

Kansas law requires…

…that each vehicle must carry a valid insurance card from a Kansas agent as proof of insurance. The insurance card must show the name of insurer, name of insured party, policy number, effective date, an expiration date that is greater than current date, vehicle description, and vehicle identification number or VIN.

Kansas law also requires that you carry “Kansas no-fault liability insurance” on any vehicle except a motorized bicycle so that, in case of an accident, the other vehicle and its passengers are protected.

Auto Titles

- New to Kansas

- Gather Required Documents

- Gather Additional Documents

- Request for Original Title

Kansas law requires that a vehicle must be registered and display a plate along with the corresponding decals. Registration is required within 90 days of the date of establishing a Kansas domicile or residence, whether owning, renting or leasing.

Once a vehicle is registered, the owner is responsible for the annual renewals prior to expiration.

Original Title – We cannot accept a copy of the title. If your lienholder (lender) or previous state is holding your title, see “Request for Original Title”.

VIN Inspection – The Montgomery County Sheriff’s office will complete the VIN inspection for your vehicle.

Proof of Insurance – Include a copy of your insurance card or supply insurance provider, policy #, and expiration date.

Previous State’s Registration – Include a copy of your registration from the previous state you are transferring to Kansas from.

Power of Attorney – Required if both owners cannot be present for joint title and registration.

Sales Tax Receipt – Required if purchased from a licensed Kansas dealer.

Sales Tax Receipt and Bill of Sale – Required if vehicle was purchased less than 6 months ago.

Lien Release – Required if the current title shows a lien and you have paid off the loan.

Certificate of Trust – Required if titling in the trust’s name.

The Montgomery County Tag Office can assist you in obtaining the original title from the lien holder.

Auto Tag Renewals

- Renewals

- Renew in Person

- Renew by Mail

- Renew Online

Renew Your Vehicle Registration

Kansas Law requires motor vehicle registration to be renewed each year with a license plate displaying the current year’s decal. Motor vehicles cannot be legally operated without a current registration. To renew your vehicle registration, you must pay registration fees and personal property taxes each year. In return, you will receive a current year’s decal to be placed on your plate.

When to Renew

You should receive a courtesy notice about 30 days before the vehicle registration expires. The renewal schedule is based on the first letter of the registered vehicle owner’s last name.

The best way to renew is online or by mail. However, if you need to renew at the front counter in-person, the best time is in the middle of the week and during the middle of the month. Customer volume is lower in the middle of the month due to renewal schedules. Nearing month end, wait times may exceed two hours.

- Please bring valid proof of insurance for each vehicle.

- Pay by cash or check (with valid id), money order or cashier’s check.

- There is a convenience fee charged at the Coffeyville Tag Office.

- There will be a $30 service charge for each returned check.

To renew by mail:

- Pay by check, money order or cashier’s check. Please do not send cash in the mail. There will be a $30 service charge for each returned check.

- You may write one check if renewing multiple vehicles.

- Include valid proof of insurance for each vehicle.

- Allow 5 to 7 business days to receive your registration receipt and decal by mail.

- Include renewal stub, payment and proof of insurance in the envelope provided with your renewal notice and mail to:

Montgomery County Treasurer

PO Box 767

Independence, KS 67301

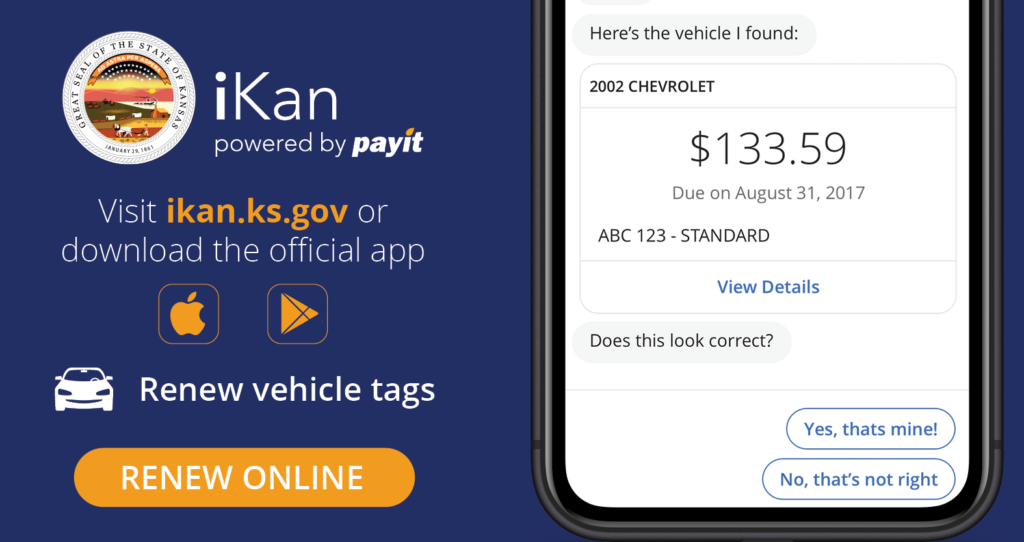

To renew online:

- Go to https://ikan.ks.gov

- Pay by eCheck or by credit card. There is a convenience fee charged by the payment processor.

- Requires a PIN number located on your on your vehicle registration renewal notice.

- Remember to save your confirmation number.

- Allow 5 to 7 business days to receive your registration receipt and decal by mail.

Some registrations may not qualify for electronic renewal.

Contact Us

County Treasurer

PO Box 767

Independence, KS 67301

Phone: (620) 330-1100

Fax: (620) 330-1155

Hours: Monday – Friday 8am – 4pm

There are no titles processed after 3:00pm

Located on the first floor of the County Courthouse.